will capital gains tax rate change in 2021

Long-term capital gains tax rates for the 2021 tax year. Tax Changes and Key Amounts for the 2022 Tax Year.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Or sold a home this past year you might be wondering how to avoid tax on capital gains.

. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Capital Gains Tax Rate 2021. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Short-term capital gains are taxed at ordinary income tax rates up to 37 the seven marginal tax brackets are 10 12 22 24. The effective date for this increase would be September 13 2021. Experienced in-house construction and development managers.

Filing Status 0 rate 15 rate 20 rate. SEE MORE IRS Releases. Get Access to the Largest Online Library of Legal Forms for Any State.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. Those tax rates for long-term capital gains are typically much lower than the ordinary tax rates youd otherwise pay which can be as high as 37. The standard deduction amount for the 2022 tax year jumps to 12950 for single taxpayers up 400 and 25900 for a married couple filing jointly up 800.

Ad If youre selling stock real estate or a business youve got a 180 day window to act. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Ad Compare Your 2022 Tax Bracket vs.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Establish the date you. Or your taxable income drastically.

The proposal would increase the maximum stated capital gain rate from 20 to 25. How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center 500000 of capital gains on real estate if youre married and filing jointly. Typically you pay a higher tax rate on short-term capital holdings versus long-term ones.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor Capital Gains Tax What It Is How It Works Seeking Alpha What S In Biden S Capital Gains Tax Plan Smartasset What You. Weve got all the 2021 and 2022 capital gains. Capital Gains Tax Rates for 2021 and 2022.

409 Capital Gains and Losses Internal Revenue Service. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains. Add this to your taxable.

Experienced in-house construction and development managers. Use these rates and allowances for Capital Gains Tax to work out your overall gains above your tax-free allowance. 19if the capital gains inclusion rate increases in a spring 2021 budget the client does not need to do anything more.

Small business exclusion of capital gains for individuals at least 55 years of age of R18 million when a small business with a market value not exceeding R10 million is. 4 4A Guide to the Capital Gains Tax Rate. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Long-term capital gains are capital assets held for more than a year. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most. Ad If youre one of the millions of Americans who invested in stocks.

Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. If your income was between 0 and 40000. Learn More About The Adjustments To Income Tax Brackets In 2022 vs.

You can change your cookie settings at any time. Includes short and long-term Federal and. The capital gains tax rate for tax year 2020 ranges from 0 to 28.

When the tax was first. Ad If youre selling stock real estate or a business youve got a 180 day window to act. Your 2021 Tax Bracket To See Whats Been Adjusted.

Heres an overview of capital gains tax in 2021 -- whats changed and what could change. 5 5Definition Types Capital Gains Tax Filing FY. This 15 rate applies to individuals and.

If you are filing your taxes as a single person your capital gains tax rates in 2021 are as follows. The current capital gain tax rate for wealthy investors is 20. But because the higher tax rate as.

First deduct the Capital Gains tax-free allowance from your taxable gain. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. For most people the capital gains tax does not exceed 15.

Long-term gains still get taxed at rates of 0 15 or 20.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How High Are Capital Gains Taxes In Your State Tax Foundation

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

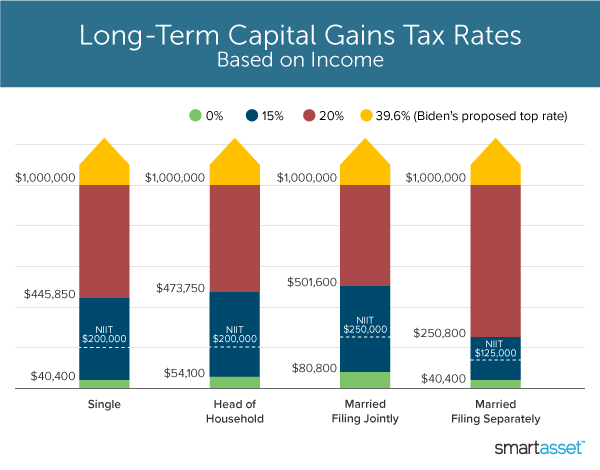

What S In Biden S Capital Gains Tax Plan Smartasset

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax What Is It When Do You Pay It

What You Need To Know About Capital Gains Tax

Capital Gains Tax What It Is How It Works Seeking Alpha

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)