south dakota sales tax on vehicles

Motor Vehicle Sales or Purchases. 5511 New Used Car Dealers 1557342097 4621258 143531007.

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

2 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases.

. Its important to note that this does include any local or county sales tax which can go up to 35 for a total sales tax rate of 75. However if purchased by an out of state business you will need to show proof of tax paid to your local Department of Revenue office. Car Dealership Areas In South Dakota.

This means that depending on your location within South Dakota the total tax you pay can be significantly higher than the 45 state sales tax. In addition to taxes car purchases in South Dakota may be subject to. What is South Dakotas Sales Tax Rate.

2 April 2015 South Dakota Department of Revenue Motor Vehicle Sales Lease and Rentals and Repairs Tax Facts Motor Vehicle Sales and Purchases With few exceptions the sale of products and services in South Dakota is subject to sales or use tax. In addition for a car purchased in South Dakota there are other applicable fees including registration title and plate fees. Average Local State Sales Tax.

South Dakota Real Property Taxes. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. It is a compulsory requirement for a.

The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. All figures are compiled by location zip code within a county.

The average sales tax rate on vehicles across the state is 5814. However should there be sales tax due the seller becomes fully liable whether the sales tax was collected or not. The South Dakota sales tax and use tax rates are 45.

Category Exemption Status. In South Dakota the median property tax rate. While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation.

South Dakota law also requires any business without a physical presence in South Dakota to obtain a South Dakota sales tax license and pay applicable sales tax if the business meets one or both of the following criteria in the previous or current calendar year. South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. The laws applicable in South Dakota allow a business person to include sales tax on the price of the products or services they offer.

Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that applies to the rental of cars trucks motorcycles and vans if the business rents them to the same person for less than 28 days. If you are interested in the sales tax on vehicle sales see the car sales tax page instead. How to Calculate Sales Tax on a Car in South Dakota.

Can I import a vehicle into South Dakota for the lone purpose of repair or modification. In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. However the average total tax rate in South Dakota is 5814.

Applies to all sales of products and services that are subject to the state sales tax or use tax if the purchaser receives or imposes a sales tax or use tax. These are State taxable. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special.

Different areas have varying additional sales taxes as well. Car sales tax in South Dakota is 4 of the price of the car. The South Dakota SD state sales tax rate is currently 45.

The state sales tax rate in South Dakota is 4500. Sales Tax Exemptions in South Dakota. To calculate the sales tax on a car in South Dakota use.

Exempt from ordinary sales tax but taxable under special 4 excise tax. South Dakota has recent rate changes Thu Jul 01 2021. 36-Franchised new motor vehicle dealer pays 4 excise tax on the manufacturers suggested retail price of a new vehicle and licenses motor vehicle-42-Dealer titles option of licensing used vehicleboat and does not pay excise tax07.

This is the amount reported on Line 2 of the South Dakota Sales and Use Tax Return. Certain trailers are also subject to the tax if they are rented for 6. This page discusses various sales tax exemptions in South Dakota.

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Your businesss gross revenue from sales into South Dakota exceeded 100000. What Rates may Municipalities Impose.

Select the South Dakota city from the list of popular cities below to see its current sales tax rate. Scroll to view the full table and click any category for more details. South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1814 on top of the state tax.

One exception is that the sale or purchase of a motor vehicle subject to the. Depending on local municipalities the total tax rate can be as high as 65. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

Other local-level tax rates in the state of South Dakota are quite complex compared against local-level tax rates in other states. Some businesses may not be within City limits. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership.

All car sales in South Dakota are subject to the 4 statewide sales tax. Though you can find automotive offerings spread out in smaller towns you may have to drive into major cities of South Dakota to find car. In South Dakota the sales and use tax rate is 45.

With local taxes the total sales tax rate is between 4500 and 7500. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

Pin On Jerry S Chevrolet Of Beresford

What S The Car Sales Tax In Each State Find The Best Car Price

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Pin On Form Sd Vehicle Title Transfer

Tennessee 2020 Passenger Issue This New Baseplate Was Introduced In January 2006 And Replaced All Previous Issues By The End License Plate Car Plates Plates

A Complete Guide On Car Sales Tax By State Shift

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Subaru 360 Taxi Owned By M Kindelberger Subaru Subaru Cars Subaru Tribeca

1956 Austin Healey 100 British Motor Company Bmc Aussie Original Magazine Advertisement Australian Cars Old Trucks Car Advertising

Nj Car Sales Tax Everything You Need To Know

Cars Trucks Vans South Dakota Department Of Revenue

A Complete Guide On Car Sales Tax By State Shift

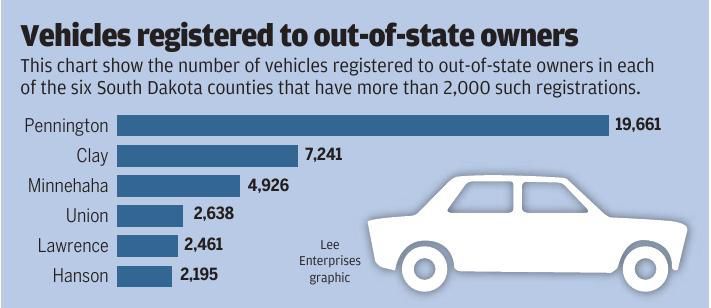

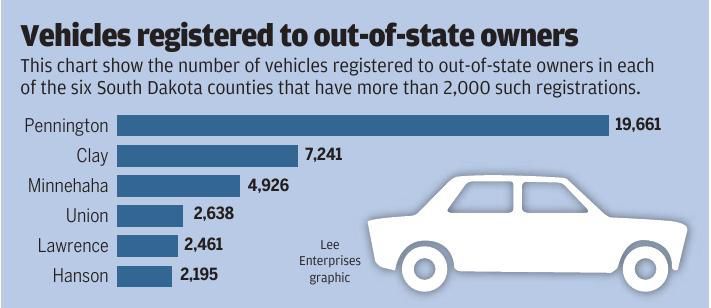

58 334 Out Of State Vehicles Registered In South Dakota Local Rapidcityjournal Com

Car Sales Tax In South Dakota Getjerry Com

Ohio 2015 Passenger Issue Ohio Introduced A New Base In April 2013 This Issue Is Called The Ohio Pride Plate And Incorpo Word Pictures Ohio Pride Car Plates

Car Sales Tax In South Dakota Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price